Health Insurance: Comprehensive Guide to Benefits, Types, and Selection

Health insurance acts as a financial safeguard against the often exorbitant expenses associated with medical care.

Without it, a sudden illness, injury, or chronic condition can lead to significant financial strain.

With a well-chosen health insurance plan, you can gain peace of mind knowing that you and your loved ones are protected against unforeseen medical costs.

In this guide, we'll delve deep into the world of health insurance, covering a wide range of topics that will empower you to make the best choices for your health and financial well-being.

Table of Contents

4. Timely Medical Attention:

7. Coverage for Family:

10. Legal Compliance:

1.2. Access to a Network of Providers

Most health insurance plans have a network of healthcare providers, making quality care more accessible.

2. Types of Health Insurance

Health insurance comes in various forms, each tailored to meet the specific needs of individuals and families. Understanding these different types of health insurance is essential to making an informed choice that aligns with your unique circumstances. Let's explore the primary types of health insurance:

|

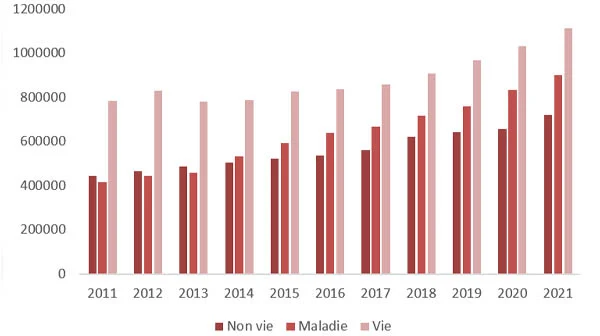

| Source: National Association of Insurance Commissioners (NAIC) data |

1. Employer-Sponsored Health Insurance:

Many individuals receive health insurance coverage through their employers. Employer-sponsored health insurance is often provided as part of an employment package.

This coverage typically extends to employees and may also include coverage for their immediate family members, such as spouses and children.

One of the significant advantages of this type of insurance is that it often comes with group rates, making it more affordable than individual plans. Employers may subsidize a portion of the premiums, reducing the financial burden on employees.

Employer-sponsored plans vary, but they generally offer a choice of healthcare networks and coverage levels. It's important to review the options available through your employer to select the plan that best suits your needs.

2. Individual Health Insurance:

Individual health insurance plans are purchased directly by individuals or families. They are suitable for those who are self-employed, not covered by an employer, or who want more control over their insurance choices.

These plans can be customized to fit your specific requirements. You have the flexibility to choose the coverage, deductibles, and premiums that align with your health needs and budget.

Individual health insurance plans are available through insurance providers, online marketplaces, or insurance brokers. It's important to carefully compare policies to find one that provides the desired level of coverage.

3. Government Programs:

The government plays a crucial role in providing health insurance options, especially for certain demographics.

Medicare: Medicare is a federal health insurance program primarily designed for seniors aged 65 and older. It also covers younger individuals with certain disabilities.

Medicaid: Medicaid is a joint federal and state program that provides healthcare coverage to individuals and families with limited income and resources. Eligibility criteria and benefits can vary from one state to another.

CHIP (Children's Health Coverage Program):

CHIP is designed to provide healthcare coverage for children in low-income families who do not qualify for Medicaid. It helps ensure that children have access to necessary medical care and services.

The Affordable Care Act (ACA) established health insurance marketplaces where individuals and families can purchase insurance plans.

These plans offer various levels of coverage, often categorized as bronze, silver, gold, or platinum, based on the proportion of costs covered.

Subsidies and tax credits are available through these marketplaces to make insurance more affordable for those with low to moderate incomes.

5. High-Deductible Health Plans (HDHPs) and Health Savings Accounts (HSAs):

HDHPs are insurance plans with higher deductibles and lower premiums. They are often paired with Health Savings Accounts (HSAs), which allow individuals to save money tax-free for medical expenses.

HDHPs are popular choices for those who want to minimize monthly premiums and are willing to take on more out-of-pocket expenses. HSAs provide a tax-advantaged way to save for these expenses.

Understanding the different types of health insurance is the first step in finding the coverage that best suits your needs and financial situation.

Take the time to assess your healthcare requirements and explore the options available to make an informed decision about your health insurance plan.

2.1. Employer-Sponsored Health Coverage

Many individuals get health insurance through their employers. These plans often come with group rates and can be more affordable.

2.2. Individual Health Coverage

If you're self-employed or don't have access to employer-based insurance, you can purchase individual health insurance plans.

2.3. Medicare and Medicaid

Medicare is a federal program for seniors, while Medicaid is a joint federal and state program that provides coverage for low-income individuals and families.

3. Selecting the Right Plan

Choosing the right health insurance plan is crucial. Consider the following factors:

- Your Health Needs

- Network of Providers

- Costs and Premiums

3.1. Assessing Your Health Needs

Assess your healthcare needs, including any pre-existing conditions, to determine the coverage you require.

3.2. Network of Providers

Make sure your preferred healthcare providers are in-network to ensure you receive care from the doctors you trust.

Low-Cost Health Coverage

3.3. Costs and Premiums

Understanding the costs associated with health insurance is

crucial when selecting the right plan for your needs. Health insurance plans

come with various financial considerations, and comprehending these elements is

essential for making an informed decision.

Premiums:

The premium is the amount you pay for your health insurance coverage. It's typically a monthly cost that you or your employer must cover. Premiums can vary widely based on the type of plan, the level of coverage, your age, your location, and other factors.

It's important to note that lower-premium plans may come

with higher deductibles, co-pays, or out-of-pocket expenses, so it's essential

to strike a balance between your monthly premium and potential out-of-pocket

costs.

Premiums can often be paid through payroll deductions for

employer-sponsored plans or directly to the insurance provider for individual

plans.

Deductibles:

A deductible is the amount you must pay for covered healthcare services before your insurance plan starts sharing the costs. For example, if you have a $1,000 deductible, you need to pay the first $1,000 of covered services out of your pocket.

Health insurance plans can have different deductible levels,

and higher-deductible plans typically have lower monthly premiums. This means

you'll pay more when you receive medical services but less each month in

premium payments.

It's important to understand the relationship between your

deductible and premium. Lower premiums often come with higher deductibles, and

vice versa. Choose a plan that aligns with your budget and your ability to

cover potential out-of-pocket costs.

Co-Payments and Co-Insurance:

Co-payments (co-pays) and co-insurance are costs you share with your insurance provider for healthcare services after you've paid your deductible.

A copay is a fixed amount you pay for specific services or

prescription drugs. For example, you might have a $20 co-pay for a doctor's

office visit.

Co-insurance is a percentage of the costs you pay after

meeting your deductible. For instance, if your plan has 20% co-insurance, you'd

pay 20% of the covered expenses, while your insurance covers the remaining 80%.

The specific co-pays and co-insurance rates can vary

depending on the plan and the services received.

Out-of-Pocket Maximum/Limit:

Every health insurance plan has an out-of-pocket maximum or limit. This is the maximum amount you will have to pay for covered services in a plan year. Once you reach this limit, the insurance provider covers 100% of covered costs.

Understanding your plan's out-of-pocket limit is crucial

because it provides a financial safety net. It ensures that you won't face

endless expenses in the event of a serious illness or accident.

This limit includes deductibles, co-pays, and co-insurance,

but not your premiums or services that are not covered by your plan.

Subsidies and Assistance:

In some cases, individuals or families with low to moderate incomes may qualify for government subsidies or tax credits that can help reduce the cost of health insurance premiums.

These subsidies are available through health insurance

marketplaces and can make insurance more affordable for those who meet income

requirements.

Understanding these cost factors is essential when selecting

a health insurance plan. Consider your budget, healthcare needs, and how you

want to balance monthly premiums with potential out-of-pocket expenses. A

well-informed decision will ensure that you have the right coverage without

overextending your finances.

Conclusion: health insurance

Health insurance is a crucial part of ensuring your health and financial well-being. By understanding its benefits, and types, and how to select the right plan, you can make informed decisions about your healthcare coverage.

Remember that health insurance needs can vary greatly from person to person, so take the time to research and compare options to find the plan that best suits your needs and budget.

Now, you are well-equipped with the knowledge to make informed decisions about your health insurance. Stay healthy and protected!

For more detailed information, consult with a healthcare professional or an insurance expert to get personalized advice.